Volume is a combination of the number of invoices and the total value. Bigger clients with more invoices always command the lowest rates. Volume is the most important factor for a factor to determine a factoring rate. It is definitely worth your time to shop around. Remember that factoring rates and advances can differ from one provider to another.

Fill in your invoice value, advance rate, and factoring rate (using a 30 day average) to compare the per dollar cost of each proposal. Given these options, “Proposal 2” is the obvious choice.Ĭlick on the image above to view the spreadsheet. The larger advance offsets the higher factoring rate. “Proposal 1” has an advance rate of 70% with a 30 day average factoring rate of 3%.Īlthough “Proposal 2” has a higher factoring rate, it’s actually about 27% cheaper based on its per dollar cost. In the example below, the invoice value is $10,000. To calculate the cost, you need the invoice value, advance rate, and factoring rate. This shows you the cost of each dollar you’re getting in the advance installment. Per Dollar Cost of Factoringĭetermining the per dollar cost is the best way to compare proposals from competing factors.

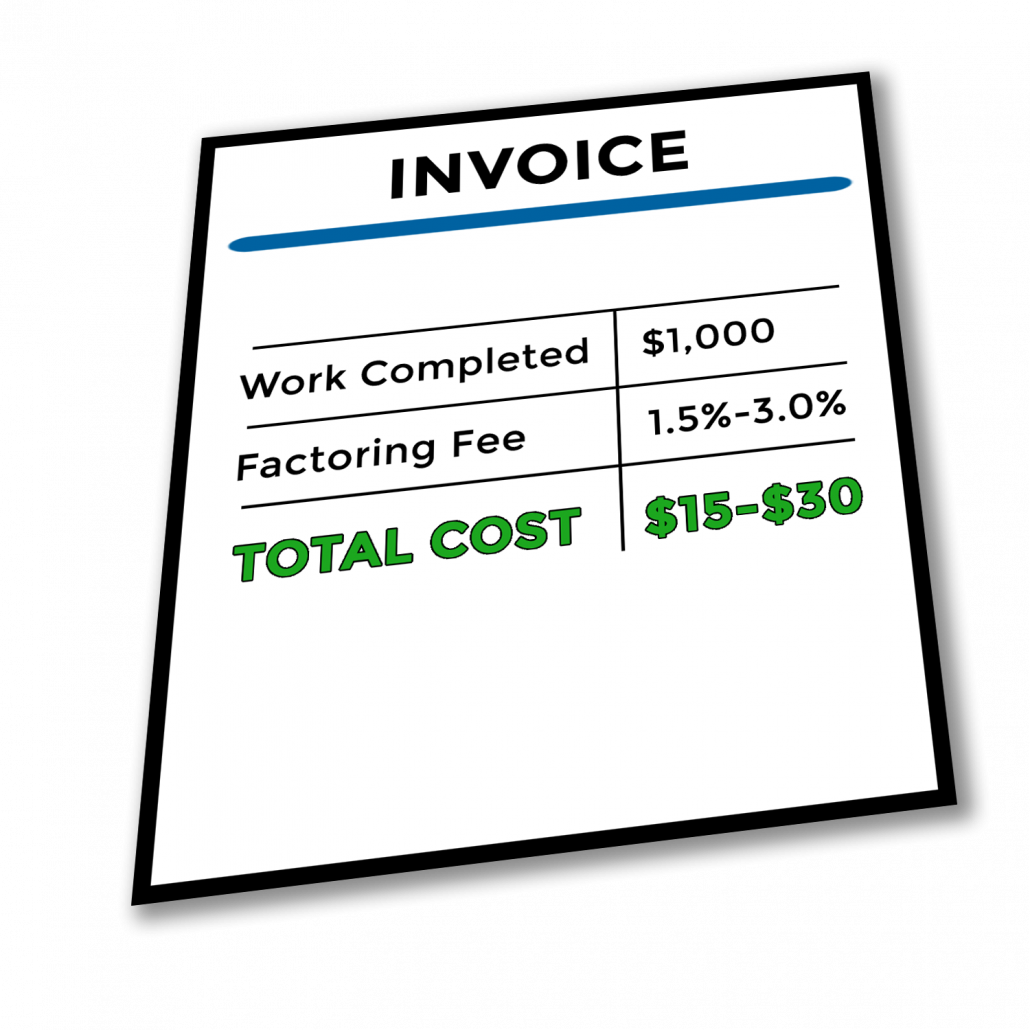

It’s better to focus on the per dollar cost of factoring – that is how much each dollar you’re advanced costs you. However, don’t get hung up trying to get the lowest rate. You have a better chance of negotiating flat rate pricing if your customers usually pay on time. Variable rate pricing carries a slight conflict of interest: since the factoring company handles collections, if they are slow to collect, it will end up costing you more since their fee increases the longer an invoice remains unpaid. Example variable rate fee structure: Rate Invoice Factoring Costs Average 30 Day Factoring Rates Industryįactoring companies often use a variable rate fee structure, especially in industries where customers often pay late or at irregular intervals. We also have another guide covering the best factoring companies. This guide will give you an overview of factoring fee structures and other costs you’re likely to find in an invoice factoring agreement and we’ll compare factoring rates with alternative financing options.

Like most things, the truth is more complicated. Most businesses searching for invoice factoring rates assume the lowest rate is best.

0 kommentar(er)

0 kommentar(er)